You claim these in your tax return at the specific expense category where available or as an Other deduction. You may deduct only the amount of your total medical expenses that exceed 75.

General Expenditures Examples Of Allowable And Unallowable Costs Child Nutrition Nysed

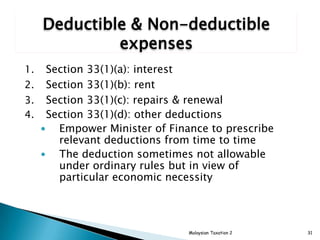

Legal and professional fees incurred relating to non-trade or capital transactions.

. FY2017 Certified Local Government Funded Project List pdf Historic Preservation Grants Program Overview The Historic Preservation Grants Program allocates state funds appropriated by the Legislature and federal funds apportioned to the state by the US. The following information applies whether use of home expenses are based on actual costs or the flat rate amount. We welcome your comments about this publication and suggestions for future editions.

The medical expense tax credit is one of the most overlooked non-refundable tax deductions. Some examples of allowable expenses you can claim are. Last lets take a look at some costs and fees that are truly non-allowable meaning VA buyers cant pay them regardless of whether the lender is charging the flat 1 percent fee.

Enter on line 22900 the allowable amount of your employment expenses from the total expenses line of Form T777. See Note 1 below Repayments of the principal loan or mortgage amount monthly instalments. An ordinary expense is a common cost or.

Impairment loss on non-trade debts. You can deduct some of these costs to work out your taxable profit as long as theyre allowable expenses. These truly non-allowable fees include.

Singapore income tax and any tax on income in country outside Singapore. One consumer unit spends an average of 5102 every month in 2018That implies that the average budget for an American is 61224 and is a 19 increase from the previous year. 502 Medical and Dental Expenses.

Contractors subcontractors and construction workers work full time seasonally or often have side jobsTo ensure you pay the correct amount of taxes keep track of your ordinary and necessary expenses for each of your jobs should the IRS ask for documentation. Installation of fixed assets. This tax credit can also be claimed for your spouse common-law partner and children under 18 years of age.

In AB 1887 the California Legislature determined that California must take action to avoid supporting or financing discrimination against lesbian gay bisexual and transgender peopleGov. Salaries and benefits for temporary staff or additional hours for existing non full-time staff to be employed for the project. Interest including late payment interest paid on the loan or mortgage taken to purchase the property that is rented out.

Legal fees for lets of a year or less or for renewing a lease of less than 50 years. 5 Any limitations set forth in this subpart. Travel andor training expenses related to the project for project staff.

3 Standards promulgated by the CAS Board if applicable otherwise generally accepted accounting principles and practices appropriate to the circumstances. 4 Terms of the contract. Flexibility in Figuring Out Whats Deductible.

The table below lists allowable and non-allowable rental expenses. Consumer units according to the BLS include families a single individual living alone or sharing a home with others but who dont depend on another financially or two more persons living in. Federal Grant Reimbursement System.

Water rates council tax gas and electricity. Real estate broker or agent commissions or fees. Costs of services including the wages of gardeners and cleaners as part of the rental agreement letting agents fees.

To prevent double taxation where a payment to an associate for example a salary payment is non-deductible under the PSI rules the amount received by the associate is not included in their assessable income. Interest expenses relating to non-income producing assets. Emergency Assistance to Non-Public Schools Program EANS EANS Application EANS Reallocated Funds Request ARP EANS II Application.

Medical expenses amount exceeding 1 of total remuneration. American Rescue Plan ARP Elementary and Secondary School Emergency Relief ESSER ESSER Performance Report. Subscriptions and licenses within the grant period that support digital inclusion efforts.

Use Form T777S to calculate your allowable home office expenses if you worked from home in 2021 due to COVID-19. If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for medical and dental care for yourself your spouse and your dependents. ARP Homeless Children and Youth II Budget Update.

The cost of business calls. NW IR-6526 Washington DC 20224. Form T777 Statement of Employment Expenses Use Form T777 to.

Although most Canadians are aware that the medical expense tax credit exists many fail to keep the necessary receipts or running tally of expenses. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Include Form T777S with your income tax and benefit return.

Example Your turnover is 40000 and you claim 10000 in allowable expenses. These expenses cant be used to reduce PSI attributed to the individual which is included in their individual tax return. Cost of managing tax affairs.

A5 To that end AB 1887 prohibits a state agency department board or commission from requiring any state employees officers or members to. Comments and suggestions. Common claims at this section include expenses such as.

You may also be able to claim a deduction for other expenses you incur that dont relate to your work or income producing activities. Attorney fees charged by the lender. Completing your tax return.

Department of the Interior National Park Service for the preservation and protection of the states historic and. Code 111398 subd. A A cost is allowable only when the cost complies with all of the following requirements.

Enter these amounts in the Calculation of Allowable Motor Vehicle Expenses area on Form T777 Statement of Employment Expenses and attach it to your paper return.

What To Include In Your Business Expense Policy Sentrichr

Claiming Business Expenses A Guide For The Self Employed Citywire

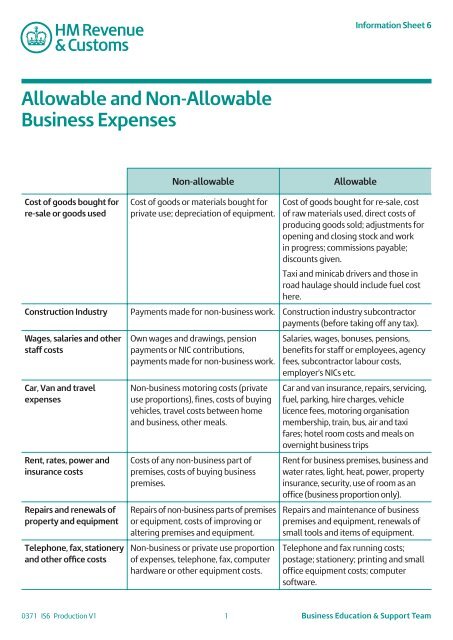

Allowable And Non Allowable Business Expenses

What To Include In Your Business Expense Policy Sentrichr

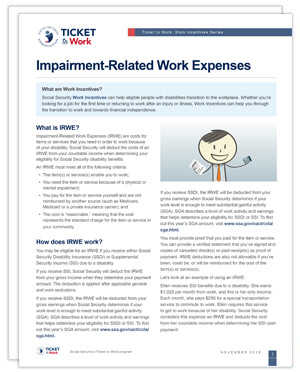

Impairment Related Work Expenses Ticket To Work Social Security

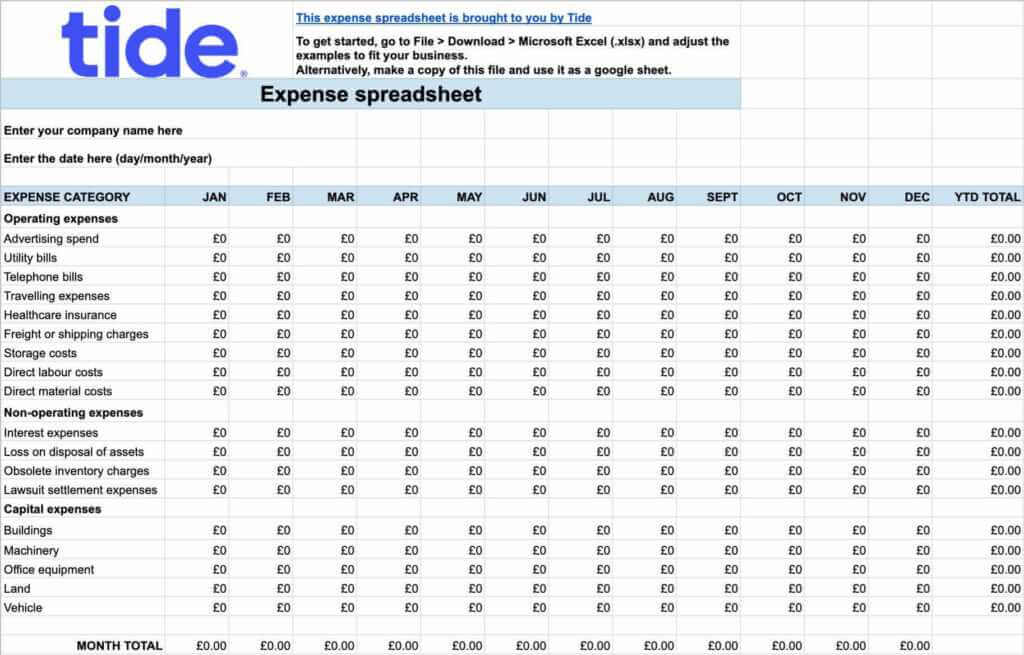

What Expenses Can I Claim As A Limited Company Tide Business

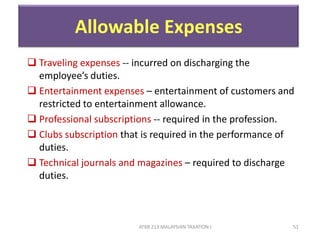

Allowable Disallowable Expenses

Chapter 5 Corporate Tax Stds 2

List Of Non Allowable Expenses In Malaysia 2018 Lucarkc

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Pdf Allowable And Disallowable Expenses Allowable Expenditure Disallowable Expenditure Sharifu Ngapawa Academia Edu

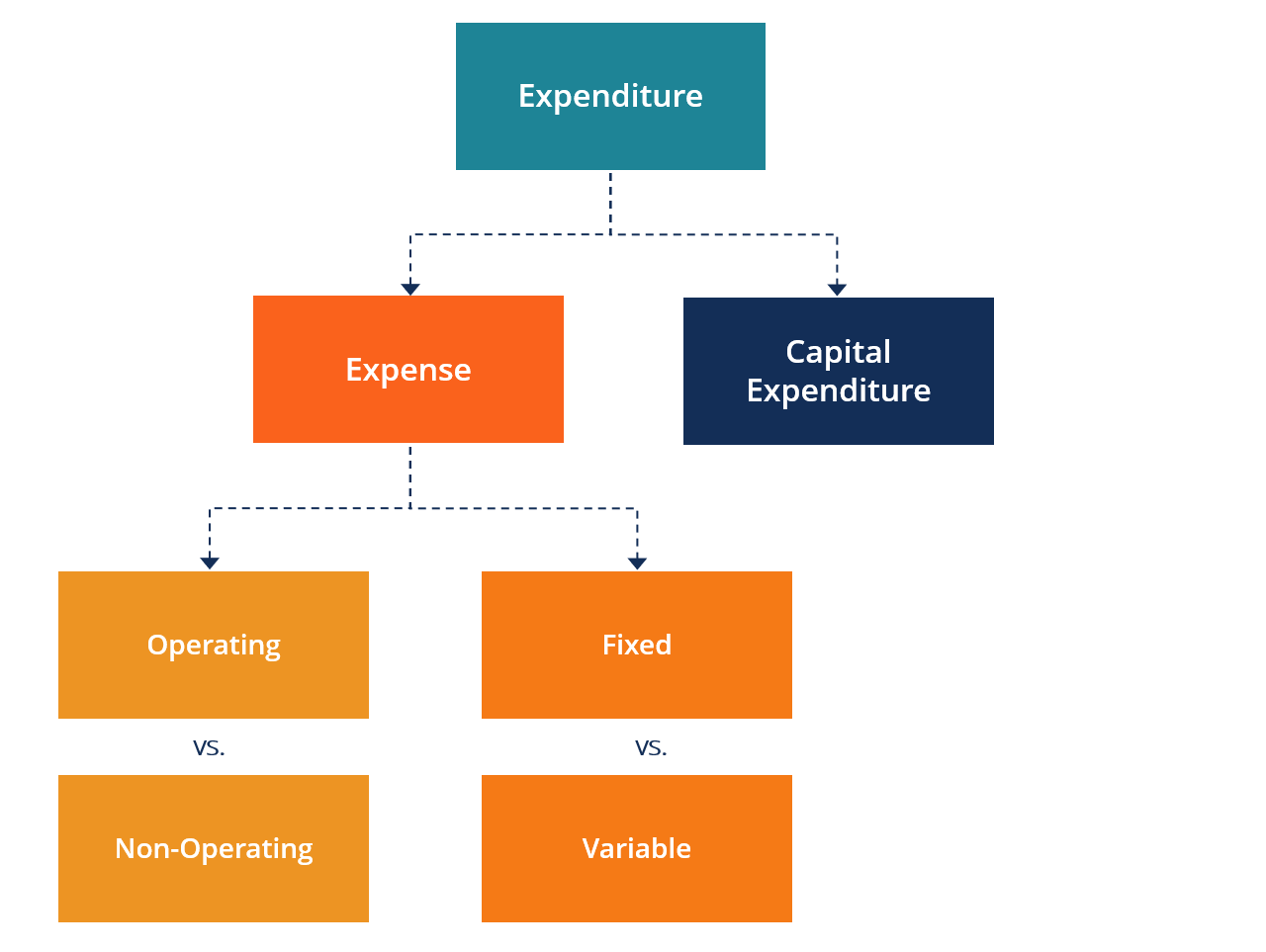

Expenses Definition Types And Practical Examples

Updated Guide On Donations And Gifts Tax Deductions

Pdf Deductible And Non Deductible Expenses

The Lesser Known Art Of Calculating Irs Allowable Living Expenses

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition